Investing in early childhood is a down payment on all our futures

Financial Times: Moral Money

MARCH 24, 2023

Businesses should play a central role in changing attitudes

Financial Times: Moral Money

MARCH 24, 2023

Businesses should play a central role in changing attitudes

A Wealth of Common Sense

MARCH 21, 2023

John Marsden grew up in a wealthy family. He was a brilliant student who went to Harvard, graduated from law school and eventually fulfilled his dream of becoming a successful lawyer. John got married in his 30s and had children. Leo DeMarco also went to Harvard where he dreamed of becoming a famous writer. But after college he became a high school teacher and loved working with his students so much that his dream never c.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The Big Picture

MARCH 22, 2023

Bank failures since 2001, scaled by amount of assets in 2023 dollars. The graphic above, via Flowing Data , puts recent events into perspective: At $209 billion in assets, the Silicon Valley Bank failure since Washington Mutual crashed in 2008 (JPM Chase took them over from the FDIC). The post U.S. Bank Failures, 2001 – Present appeared first on The Big Picture.

Private Equity Info

MARCH 21, 2023

Customer Satisfaction Survey 2023: Results Show We Exceed Client Expectations in Quality of Data, Customer Service, and Pricing In January and February of 2023, Private Equity Info surveyed clients to understand our customers' perceptions of how we are doing, relative to the type of company we aim to be. My goal, when I founded Private Equity Info in 2005, was to create the data and tools I wished I had while working as an investment banker - to easily identify highly targeted lists of the priva

The Reformed Broker

MARCH 18, 2023

And if you haven’t subscribed yet, don’t wait. Check it out below or wherever fine podcasts are played. . The post This Week on TRB appeared first on The Reformed Broker.

A Wealth of Common Sense

MARCH 24, 2023

I was always a saver growing up. Whenever I got money for birthdays, holidays, church stuff, my allowance, or summer jobs, I would sock it away. At first that was in a secret compartment in a wallet in the top drawer of my dresser. In high school, I finally opened up my first bank account. My first job was as a bus boy. I probably saved a thousand dollars that summer.

The Big Picture

MARCH 20, 2023

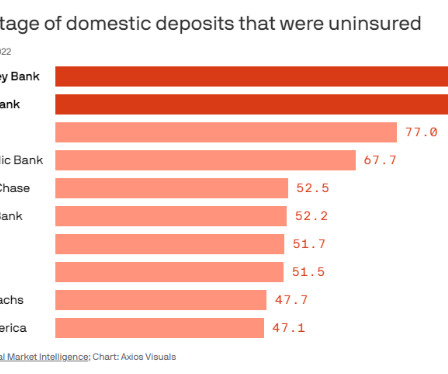

Silicon Valley Bank depositors made whole; Credit Suisse counter-parties saved; First Republic bondholders protected — are these bailouts or something else? Were these people “bailed out?” What are the differences between insured depositors getting their cash back, a private sector rescue orchestrated by the Fed or the Swiss government, and a taxpayer-funded bailout?

Private Equity Central brings together the best content for private equity professionals from the widest variety of industry thought leaders.

Financial Times M&A

MARCH 24, 2023

Results of poll add momentum to calls for a review of the forced merger and for the clawing back of bonuses

A Wealth of Common Sense

MARCH 23, 2023

A reader asks: My friend recently sent me an article saying that young people shouldn’t save money. The argument is based on the life-cycle model. It argues that in order to maximize happiness out of your income every year, and to avoid changes in standard of living throughout life, high income earners should not save at a young age, and instead it should be made up in middle ages.

The Big Picture

MARCH 18, 2023

This week, we speak with Cliff Asness , co-founder and managing partner at AQR Capital Management. The firm has ~$100 billion in assets under management. An active researcher, Asness contributes to numerous publications and has received a variety of accolades, including the James R. Vertin Award from CFA Institute in recognition of his lifetime contribution to research.

Financial Times: Moral Money

MARCH 24, 2023

With greater scrutiny by investors and new regulations, the issue of worker exploitation and abuse is more in the public eye than ever

Financial Times M&A

MARCH 22, 2023

Hong Kong and Singapore compete for offshore funds and rival hoteliers square off

A Wealth of Common Sense

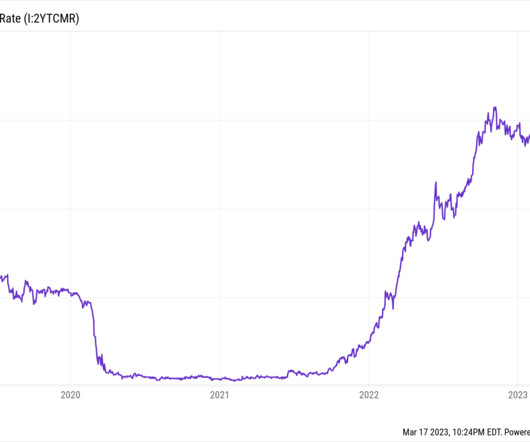

MARCH 19, 2023

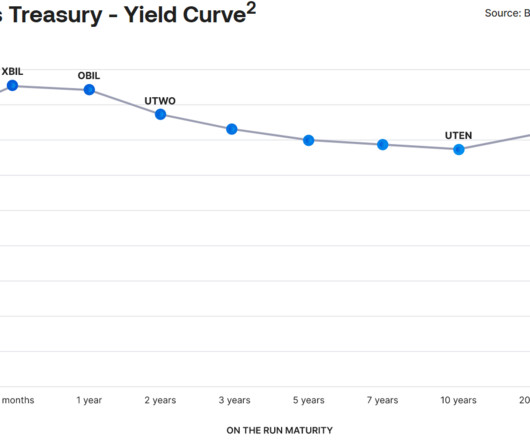

Last week Wednesday two year treasury yields closed the day at 5.05%. It was the highest level since the summer of 2006. That’s a pretty juicy yield for short-term government bonds. Unfortunately, it didn’t last. Look at the plunge in rates since the banking crisis took hold late last week: It looks like a stock market crash. This is not normal.

The Big Picture

MARCH 18, 2023

The weekend is here! Pour yourself a mug of coffee, grab a seat outside, and get ready for our longer-form weekend reads: • The A to Z of economics : Economic terms, from “absolute advantage” to “zero-sum game”, explained to you in plain English. ( The Economist ) • The Incredible Tantrum Venture Capitalists Threw Over Silicon Valley Bank : Remind me why, exactly, these guys have so much control over technological innovation?

Financial Times: Moral Money

MARCH 24, 2023

Clean energy advocates warn ‘Maga ideology’ and anti-ESG bills pose major risk to US industry and business

Million Dollar Round Table (MDRT)

MARCH 21, 2023

By Bryce Sanders You might be involved in the community, a guest at a wedding or at a college alumni event. Whatever it may be, you have opportunities to meet many people, including high-net-worth (HNW) individuals. Are you ready to make the most of those opportunities? Meeting new people is easier than you think, and it doesn’t have to be scary. Here are three steps that simplify the process.

A Wealth of Common Sense

MARCH 20, 2023

Today’s Talk Your Book is brought to you by US Benchmark Series: On today’s show, we spoke with Alex Morris, Co-Founder and CIO of F/m Investment to discuss the 2023 banking crisis and investing in treasuries. On today’s show, we discuss: The need for a treasury product for investors How US Benchmark runs their treasury ETFs What “on the run” means Why focus on one treasury duration The volatility.

The Big Picture

MARCH 22, 2023

Note: We are off to California and Arizona for a few events; no Morning Reads for the next few days… My mid-week morning train plane reads: • How the Swiss ‘trinity’ forced UBS to save Credit Suisse : The takeover of its local rival could end up being a generational boon for UBS. But the government-orchestrated deal has angered many investors. ( Financial Times Alphaville ) • Why Job Reshoring Is Merely a Trickle : U.S. manufacturing can’t compete on cost, but it has a leg up in some areas

Financial Times: Moral Money

MARCH 23, 2023

Also in today’s newsletter, the push towards greener jet fuel

Financial Times M&A

MARCH 21, 2023

US regional bank has been among the hardest hit in the fallout from Silicon Valley Bank’s collapse

A Wealth of Common Sense

MARCH 22, 2023

Today’s Animal Spirits is brought to you by YCharts: Enter your information here to get 20% off YCharts (new clients only) On today’s show, we discuss: The 72-hour scramble to save the United States from a banking crisis Why failed Silicon Valley Bank was an outlier The bank panic should not exist Prescriptive View: Three layers of Fed failure What gets lost when you rescue markets US Bank deposits fell $54B.

The Big Picture

MARCH 20, 2023

My back to work morning train WFH reads: • Your NCAA Tournament Bracket Is a Business School in Disguise : What can you learn from the biggest upsets in college basketball? ( Wall Street Journal ) • What CEOs Are Getting Wrong About the Future of Work—and How to Make It Right : To build better companies, leaders need to experiment more, quit ‘living in fear of opening Pandora’s box,’ says Wharton management professor Adam Grant. ( Wall Street Journal ) see also Why Job Reshoring Is Merely a Tric

Financial Times: Moral Money

MARCH 22, 2023

RockCreek chief says impact of US Inflation Reduction Act is at risk

Financial Times M&A

MARCH 19, 2023

Regulators engineer takeover of stricken bank by larger Swiss competitor after frantic weekend

Million Dollar Round Table (MDRT)

MARCH 23, 2023

By Addie Murdock Since the MDRT Foundation began in 1959, the generosity of MDRT members funded the global grants programs that built stronger families and communities worldwide. The Foundation has awarded more than $40 million in grants in more than 70 countries since its inception. Fundraising has played a crucial role in providing these grants. During the past six decades, thousands of MDRT members volunteered their time and talent to come together for a few days a year, make phone calls and

The Big Picture

MARCH 21, 2023

Note: We are off to California and Arizona for a few events later this week; publishing will be spotty… Welcome to Spring! Start the new season with our Two-for-Tuesday morning train reads: • Are Banks OK? Where the sector stands after a turbulent week. ( Slate ) see also Déjà Vu? Why 2023 is Not 2008 : But that is incomparable to the 2008-09 era, where every financial institution had consumed CDOs, where toxic sub-prime loans were securitized into ticking time bombs.

Financial Times: Moral Money

MARCH 24, 2023

Also in today’s newsletter, the green hydrogen race heats up

Financial Times M&A

MARCH 19, 2023

This is a messy, ugly transaction that nobody really wants — but it’s also necessary

Million Dollar Round Table (MDRT)

MARCH 19, 2023

By David Batchelor, Dip PFS, CFP We went from asking for referrals in a way that was random and without a process to a strategy that was more specific and straightforward. This helped bring massive growth in my business — up to 500%. Specific referrals Like many financial advisors, we had previously asked for referrals using the standard, “Who do you know?

Integrity Financial Planning

MARCH 24, 2023

Going to museums can be a truly joyful experience that offers a wealth of cultural, historical, and artistic treasures. Here are some of the reasons why visiting museums can be such a rewarding experience. Cultural enrichment : Museums offer a unique opportunity to learn about different cultures and gain a deeper understanding of the world around us.

Zajac Group

MARCH 20, 2023

Concentration risk is an issue of interest to nearly every employee, executive, business owner, or anyone else holding company stock and employee stock options. What is concentration risk? It’s loosely defined as holding a significant portion of wealth in a single stock, which could result in an inappropriately diversified portfolio. Unfortunately, the ambiguity associated with the statement, “an inappropriately diversified portfolio,” is part of what makes identifying, addressing, and exiting a

Financial Times M&A

MARCH 20, 2023

Regulators effectively paid New York Community Bancorp to take troubled lender away

Financial Times: Moral Money

MARCH 21, 2023

Financial Conduct Authority criticises ‘widespread failings’ in ESG benchmarks

Integrity Financial Planning

MARCH 19, 2023

What Is Rolling Recession You may have noticed that the economy after the pandemic has been very up and down. And while there has been talk of a possible recession for a few years now, we have yet to completely enter a recession. A recession is traditionally defined as a consistent, widespread downturn in the economy. [1] And although there have been major market downturns recently, there have also been major rallies.

The Reformed Broker

MARCH 19, 2023

Dan McMurtrie crushed it on TCAF this week. In case you haven’t gotten to it yet, the whole video is embedded below. You can also listen to it if you’re on the go. At the 25 minute mark, he does this really great explanation of why shorting stocks is so hard, including the toll it can take on a trader’s mental health – even when they end up being right.

Financial Times M&A

MARCH 23, 2023

Sale of struggling conglomerate would be country’s largest take-private deal

A VC: Musings of a VC in NYC

MARCH 20, 2023

Mike Zamansky is the person who got me interested in K12 Computer Science Education in NYC, a cause I have now contributed almost fifteen years of my life to. Our family’s public charity, Gotham Gives , has been funding the work we do in K12 Computer Science Education in NYC for the last decade and a month or so ago, the Gotham Gal recorded a podcast with Mike talking about the early days of our journey into K12 Computer Science, how we met, and what transpired.

Let's personalize your content