France to pay €9.7bn for nationalisation of EDF

Financial Times M&A

JULY 19, 2022

Government to offer €12 per share to investors to take full control of power group

Financial Times M&A

JULY 19, 2022

Government to offer €12 per share to investors to take full control of power group

The Big Picture

JULY 22, 2022

After yesterday’s discussion on the uncertainty monster , a friend who “loves perspective changers” reached out with a challenge: “Most people rarely question their own basic ideas,” he said, He challenged me to find 10 concepts to do just that. I agreed to give it a shot, assembling a list of my own, filling it out with a few classics from others: Uncertainty : Objectively speaking “uncertainty” does not increase or decrease – by definition, the future is always inherently uncertain.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

A Wealth of Common Sense

JULY 22, 2022

Frank Rabinovich was a portfolio manager and technology specialist at bond giant PIMCO in the 1990s. The way his colleagues treated him was a microcosm of the culture at the firm in its heyday. Co-workers would douse him with bug spray, claiming he smelled bad. They cut off the bottom of his ties when they didn’t like the look of them. They tackled him relentlessly in games of touch football since he wasn’t as.

Million Dollar Round Table (MDRT)

JULY 17, 2022

By Bryce Sanders Financial advisors are trained to ask clients for referrals, and so from time to time we ask, “Do you know anyone I can help?” Put on the spot, though, sometimes our clients’ minds go blank. Yet, happy clients can be your best advocates. How can we do a better job at asking for referrals? Who wants an extra slice of pie? Your client asked about a specific product.

The Reformed Broker

JULY 16, 2022

And if you haven’t subscribed yet, don’t wait. Check it out below or wherever fine podcasts are played. These were the most read posts on the site this week, in case you missed it: The post This Week on TRB appeared first on The Reformed Broker.

The Big Picture

JULY 20, 2022

Barry Ritholtz, Ritholtz Wealth Management Chairman and CIO & “Masters in Business” host, discusses investing in a volatile market and the probability the Fed causes a recession. Risk, Reward Two Sides of Same Coin, says Ritholtz. ?. Source: Bloomberg , July 19th, 2022. Previously : Rally , Multiple Compression , Earnings¯_(?)_/¯ Recession , Double Bottom (July 18, 2022).

A Wealth of Common Sense

JULY 21, 2022

A reader asks: I’ve been buying the dip for the past couple of months in the market and feel pretty comfortable in my positions. Should I continue to buy the dip or invest in my home (ie, new fence, additional rooms/bathroom, etc.? I understand the line of thinking here but I look at the stock market and investing in your home as two separate categories when it comes to capital allocation decisions.

Private Equity Central brings together the best content for private equity professionals from the widest variety of industry thought leaders.

Investment Writing

JULY 19, 2022

When two consecutive adjectives modify the same noun, you’re supposed to put a comma between them. I sometimes struggle to decide if that’s appropriate. After all, there are cases when the first adjective modifies the second, as in “pale blue paper.” So I was delighted to find this advice from Jan Venolia in Write Right! : One way to determine consecutive whether adjectives modify the same noun ( a young, energetic student ) is to insert the word and between the adjectives.

The Big Picture

JULY 17, 2022

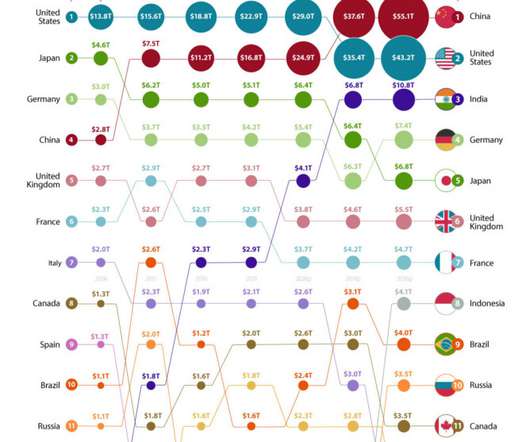

Visualizing the Coming Shift in Global Economic Power (2006-2036p). Source: Visual Capitalist. I never know what to make of these grand extrapolations but submitted for your approval… The post Coming Shift in Global Economic Power? appeared first on The Big Picture.

A Wealth of Common Sense

JULY 19, 2022

My latest piece for Fortune compiles a lot of the work I’ve been putting together here on the blog — how long bear markets tend to last, the two types of bear markets, bear markets vs. recessions and how investors should approach down markets depending on where they are in their investing lifecycle. * The technical definition of a bear market in stocks is a drawdown of 20% or worse from peak to trough.

Financial Times: Moral Money

JULY 17, 2022

Investors are starting to look more favourably on energy companies because of their role in the transition to a decarbonised economy

Financial Times M&A

JULY 22, 2022

Proposal by Sam Bankman-Fried’s affiliates would offer accounts to customers of failed crypto group

The Big Picture

JULY 22, 2022

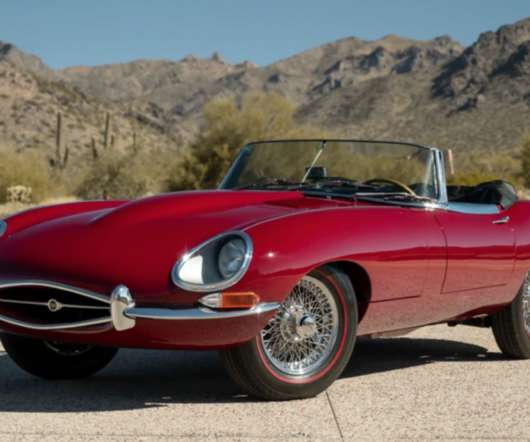

Has there ever been a sexier, more lovely roadster than the Jaguar E-Type? It is perhaps the most beautiful convertible — ever. Even Enzo Ferrari called the E-Type ‘ The most beautiful car ever made.” And a 150-mph top speed didn’t hurt either. The E-Type was continually upgraded from 1961 through 1975 while retaining its spectacular styling. The original 3.8-liter XK straight-six made 265bhp from the factory; the engine grew to 4.2 liters. and produced the same 265 horsepower as the 3.8-l

A Wealth of Common Sense

JULY 17, 2022

The last time inflation was this high was November of 1981. I was 3 months old at the time. There are some similarities between now and then. There was an energy crisis back then just like there is today. The Fed was tightening monetary policy to fight inflation in the early-1980s as well. And people were increasingly unhappy about the economic state of affairs.

Financial Times: Moral Money

JULY 17, 2022

Businesses’ impact on nature poses risks that are both severe and hard to quantify

Financial Times M&A

JULY 21, 2022

Ecommerce group announces all-cash deal as it continues expansion into healthcare sector

The Big Picture

JULY 22, 2022

My end-of-week morning offsite reads: • A New Bull Market Can’t Start Until Investors Give Up For a new cycle to begin, people who bet on the market need to capitulate. Problem is, they’ve forgotten what that feels like. ( Wall Street Journal ). • What’s Going On…With Jobs The June jobs report was cheered by economic bulls given its strength in level terms, but rates of change among leading indicators don’t favor a soft-landing outcome for the economy. ( Charles Schwab ) see al

Integrity Financial Planning

JULY 20, 2022

What are the risks of making emotional decisions when it comes to your money? Brian shares what he tells clients about investing and retirement planning. During the football draft, so many decisions are based on emotions. For instance, Tom Brady, the greatest of all time, was 199 th pick when he was drafted in 2000. Similarly, investors who want to plan their own retirement might pick stocks based on emotions that they later regret.

A Wealth of Common Sense

JULY 20, 2022

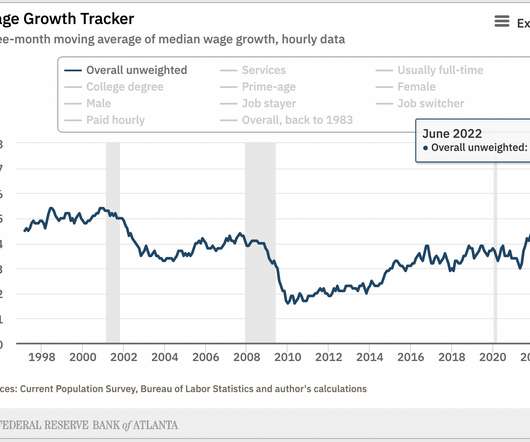

Today’s Animal Spirits is brought to you by YCharts: See here for YCharts Highlights, Lowlights, and insights from 1H 2022 On today’s show we discuss: Inflation isn’t getting better yet Inflation has outpaced wage growth The deflation risk How would investors react if we got some inflation (June 2020) Fed officials preparing to raise rates by another 75bps Average car payments hit a record high Investors h.

Financial Times M&A

JULY 20, 2022

The seller-friendly contract contains a nuclear option to force a purchase

The Big Picture

JULY 18, 2022

Ignore the emojis in the headline long enough to ask yourself this question: What might the rest of 2022 look like ? I did that exercise last week in response to a client inquiry about the second half of the year. The context was excess cash looking for a good long-term home (not a trade). The question was not so much where to put the capital, but rather when to deploy it.

The Reformed Broker

JULY 22, 2022

Welcome to the latest episode of The Compound & Friends. This week, Michael Batnick, Shannon Saccocia, and Downtown Josh Brown discuss the Nasdaq bounce, inflation vs spending, good news for the economy, Shannon’s ideas for the second half, and much more! You can listen to the whole thing below, or find it wherever you like to listen to your favorite pods!

Financial Times: Moral Money

JULY 18, 2022

Plus, carbon offsets and lobbying pose greenwashing risks

Financial Times M&A

JULY 20, 2022

The M&A playbook of warped incentives, rent extraction and creative accounting is overdue a rewrite

The Big Picture

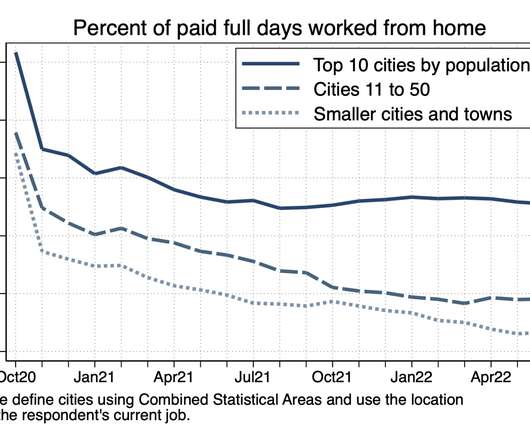

JULY 21, 2022

My morning train WFH reads: • Interest-Rate Pain From Higher Inflation Has Barely Begun : Stocks, houses, corporate borrowers and the federal Treasury may not be ready for a world of much higher real interest rates ( Wall Street Journal ). • A Warren Buffett Protégée Strikes Out on Her Own : Tracy Britt Cool spent a decade working closely with the renowned investor.

Conneqtor

JULY 20, 2022

Establish Authenticity So, what does it mean to be authentic? Yes, the heading here is very different from our title: How to use LinkedIn for Financial Advisors, but bear with me, and you’ll quickly find that both these sentences answer the same thing – the humanization of your brand.

Financial Times: Moral Money

JULY 17, 2022

Geologists scour outback for commodity used in EV batteries as Canberra seeks to diversify from fossil fuels

Financial Times M&A

JULY 21, 2022

Plus, HSBC installs Communist party committee and an interview with Shell boss Ben van Beurden

A VC: Musings of a VC in NYC

JULY 18, 2022

Every quarter our firm goes through a process to value our entire portfolio. Those values, on a schedule of investments we publish to our investors every quarter, flow through to our financial statements and capital accounts and establish how much an interest in our partnerships are worth at that time. We have always taken this process very seriously and approach it with a lot of rigor.

Financial Symmetry

JULY 18, 2022

Increasingly, we as investors want to incorporate sustainable companies and business practices into our lives. Fortunately, there are many areas of our lives where we can intentionally spend and direct our dollars to facilitate the change we want to see … Continued. The post Is ESG Investing Right For Me? appeared first on Financial Symmetry, Inc.

Financial Times: Moral Money

JULY 17, 2022

Policymakers want to make the country a world leader in green finance, but without scaring businesses away

Million Dollar Round Table (MDRT)

JULY 19, 2022

By Bryan J. Sweet, CLU, ChFC, and Brittany Anderson In the financial services world, we are faced with issues of not being trusted and then of prospects receiving an avalanche of indistinguishable blurry marketing messages. How do you overcome this and stand out from the marketing noise? And how do you avoid making your marketing all about you? First of all, understand this harsh reality check: No one cares about you.

XY Planning Network

JULY 18, 2022

6 MIN READ. Although seemingly obvious, it’s worth saying—a firm isn’t a firm without clients. It can be tempting to think of your marketing activities as aside from your actual firm and what it is you do day to day. The truth is, as a firm owner, your success depends just as much on your ability to effectively communicate your value proposition with your ideal client as it does on you delivering that value.

Financial Times: Moral Money

JULY 17, 2022

Investors and policymakers should focus more on the greening of the grey industries

Financial Times M&A

JULY 18, 2022

Producer is a notable laggard of its peers

Million Dollar Round Table (MDRT)

JULY 21, 2022

By Laura H. Mattia, Ph.D., CFP While the journey through grief and widowhood is unique to each widow, it will likely progress through four stages of transition. The following are the four stages and what you should focus on to help her through her journey: 1. Preparation is where she has time to get her financial life in order and brace for what she knows is about to happen.

Let's personalize your content