BNP Paribas approached Dutch government about ABN Amro acquisition

Financial Times M&A

JUNE 17, 2022

Deal would be first major move in long-expected wave of consolidation across Europe’s banking sector

Financial Times M&A

JUNE 17, 2022

Deal would be first major move in long-expected wave of consolidation across Europe’s banking sector

Financial Times: Moral Money

JUNE 16, 2022

There is a risk that, even as regulators crack down on greenwashing, consumers become more cynical

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

A VC: Musings of a VC in NYC

JUNE 12, 2022

I have worked in three venture capital firms in the thirty-six years I have been doing venture capital investing. They have all been small partnerships, between three and seven investing partners, where there is little to no hierarchy amount the partners. There are many models out there for building and managing investment firms. They vary from a single partner to an organization structure that looks like a Fortune 500 company.

Wealthfront

JUNE 17, 2022

We’re thrilled to announce we’re raising the APY on the Wealthfront Cash Account from 0.85% to 1.40% following the Federal Reserve’s decision to raise the target range for the federal funds rate. That means your cash will earn nearly 20x the interest at Wealthfront it would earn in a traditional savings account. And of course, […]. The post The Wealthfront Cash Account Now Has a 1.40% APY appeared first on Wealthfront Blog.

Financial Times M&A

JUNE 16, 2022

Owners of portfolios spanning London’s Covent Garden and Soho will combine in all-share deal

Financial Times: Moral Money

JUNE 15, 2022

Perpetual infrastructure programme to invest more than half its assets in Europe due to Ukraine war

Hubly

JUNE 17, 2022

There is a new focus in advisor technology to drive business process automation, digitally transform the client experience, and keep back office workers happy and productive.

Private Equity Central brings together the best content for private equity professionals from the widest variety of industry thought leaders.

Financial Times M&A

JUNE 15, 2022

While others move wealth ahead of critical election, Jaime Gilinski is aiming for the country’s crown business jewels

Financial Times: Moral Money

JUNE 14, 2022

Names Rule amendments could have a particular impact on thematic ETFs, analysts say

Elevating Your Business

JUNE 17, 2022

I was recently quoted in an article published online and offline from Investors Business Daily. Here's the entire article Comment Below As a planner, how did you change your planning process to make it more client friendly? As a consumer, what would you like your planner to do differently? #financial planning, #change, #planning. The post Article: Succinct Financial Plans Spur Clients To Act appeared first on Women Financial Advisor Coach Consultant.

Bell Investment Advisors

JUNE 17, 2022

Forrest Bell, CFP®. The volatility which has dogged financial markets this year continued during May. After a gain of over 4% in the first few trading days, the U.S. stock market declined for several sessions until it was 5.5% below its April closing level. This peak-to-trough swing was nearly 10%, echoing prior drawdowns that occurred in January, February, and April.

Financial Times M&A

JUNE 15, 2022

Chemist chain is not a business that can be fixed by some fancy financing

Financial Times: Moral Money

JUNE 13, 2022

The boom in ESG investing is drawing regulatory scrutiny on both sides of the Atlantic

Integrity Financial Planning

JUNE 16, 2022

Taxes could be one of your biggest expenses in retirement. But once you have an estimate for your tax burden in retirement, you can consider ways to minimize it. The first step towards creating a tax minimization strategy in retirement is looking at how your different sources of income will be taxed. Pensions. If you have a private pension, your pensions payments could be taxed at ordinary income rates.

Wealthfront

JUNE 16, 2022

A recession, commonly defined as two quarters in a row of shrinking gross domestic product (GDP), is generally considered bad news. Recessions cause real suffering, especially through rising unemployment and general financial uncertainty—so it’s normal to feel concerned about an economic slowdown and the impact it could have on you and your loved ones.

Financial Times M&A

JUNE 14, 2022

Energy billionaire wants to buy the 17% of Continental that his family does not already own

Financial Times: Moral Money

JUNE 13, 2022

Plus, European regulators turn their sights on ESG ratings

Integrity Financial Planning

JUNE 16, 2022

When we think of milestone birthdays, we often think of ones that are already behind us – like 18 and 30. But there are plenty of important birthdays ahead of you, especially as you near and enter retirement. Starting at age 50, several birthdays are critical to acknowledge because they can have implications for your retirement and tax situation. Age 50.

Bell Investment Advisors

JUNE 16, 2022

You worked hard all your life, managed your money responsibly, and — lo and behold! — your efforts paid off. You find yourself in your golden years in the enviable position of having more gold, so to speak, than you need in your lifetime. You could simply pass on whatever’s left to your kids and grandkids after you’re gone. But why wait?

Financial Times M&A

JUNE 14, 2022

CMA may have to look again at decision as result of Facebook parent’s one successful challenge at tribunal

Financial Times: Moral Money

JUNE 17, 2022

Plus, the comment period on the SEC’s big climate proposal comes to an end

Integrity Financial Planning

JUNE 16, 2022

We’ve come a long way from trading pelts and seashells as currency, and there have been many changes to how we produce and use currency between then and now. The value of currency and inflation affect us all, as we’ve seen recently at the gas pump and the grocery store. Here’s what we can learn about our present from the history of money. Inflation Then and Now.

Zajac Group

JUNE 15, 2022

Who doesn’t love a great tax break? You and I can’t personally reverse a bear market or revise Federal regulations. But we do get to decide when and how to exercise, hold, and sell our incentive stock options (ISOs), dictating whether we have a qualified disposition or disqualified disposition. Why not make best use of your tax-planning powers when you do?

Financial Times M&A

JUNE 13, 2022

Most arbs seem to think that discretion is the better part of valour

Financial Times: Moral Money

JUNE 15, 2022

Plus, ‘ecocide’ prevention comes for banks and pension funds

Integrity Financial Planning

JUNE 15, 2022

What options do you have when it comes to protecting your assets and investments? Brian discusses our current economy and shares what some of his clients have been doing about it. With interest rates up and the stock market down , what’s the silver lining? How can we protect our hard-earned capital and look for other opportunities? Brian says it really depends on the client and what their financial needs and goals are.

Tobias Financial

JUNE 14, 2022

Is your life insurance coverage sufficient? Many people underestimate what a surviving family needs in order to continue living a comfortable life. Often it is not until a life-changing event that clients ensure their coverage is adequate. In fact, due to Covid concerns, life insurance policy sales grew 5% last year resulting in the largest annual increase in decades.

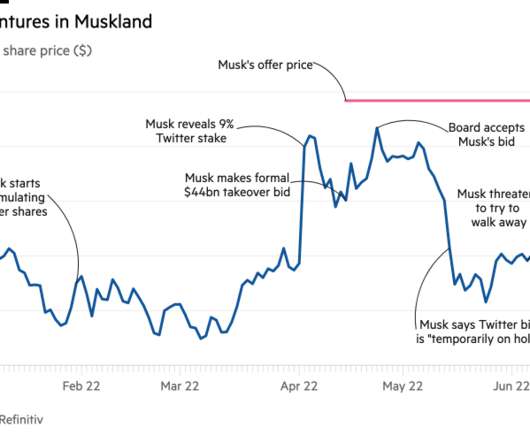

Financial Times M&A

JUNE 12, 2022

Tesla boss has suggested financing is at risk, but so are fat fees

Investment Writing

JUNE 14, 2022

If you work in a marketing or editorial group, the pieces that you work on may get comments from many different people. Sometimes your next step should be to send the piece to an editor to clean up or proofread the writing. Other times, you need to send the piece back to the subject-matter expert—often called a SME in the marketing world. When to send to the expert.

Hubly

JUNE 13, 2022

Sonya served in a medical office where she gained a lot of experience in client service. Now, she is a superstar administrative tax assistant and office manager who uses her prowess to bring her joy in her every day work with the clients at her firm.

XY Planning Network

JUNE 13, 2022

5 MIN READ. Outside investment managers—such as TAMPs and robo-advisors—are a popular solution for advisors seeking to offer clients expert asset management services without needing to hone that expertise themselves or simply spend the time doing it (as in financial planning-only firms). There are a number of different options when it comes to choosing an outside manager as an advisor and we'll discuss several options.

Financial Times M&A

JUNE 12, 2022

Hundreds of workers stand to collect $175,000 in average profits after sale of CHI Overhead Doors

Don Connelly & Associates

JUNE 13, 2022

Successful financial advisors know that client retention is vital for sustaining and growing their business. Replacing a client who leaves with a new client is expensive and hard work, costing five to 25 times more than retaining an existing one. Success at retaining clients enables advisors to focus on delivering value to them instead of having to pursue new clients.

Elevating Your Business

JUNE 13, 2022

Best practice systems identify the bottlenecks in your workflow. Creating systems involves examining a process step by step so that you find hiccups and other problems. The process of defining and refining your workflow with systems makes your business run smoothly. Which of these best practice systems is your firm missing? Use the list below. The post 19 Best Practice Systems for Growing Businesses appeared first on Women Financial Advisor Coach Consultant.

Financial Symmetry

JUNE 13, 2022

Most of us believe we’ll always have more time with our spouse, but when that time is cut short, we’re often left with too many questions and not enough answers. On today’s show, we tackle the emotionally challenging subject of … Continued. The post Tax Changes to Consider After the Death of a Spouse, Ep #166 appeared first on Financial Symmetry, Inc.

Financial Times M&A

JUNE 12, 2022

Kentaro Okuda says rate rises and Toshiba privatisation will usher in ‘paradigm shift’ for corporate Japan

Kayne Capital

JUNE 15, 2022

… The post 2022 Leaders of Influence – Private Equity Investors and Advisors appeared first on Kayne Capital.

Let's personalize your content