Microstrategy Jumps Another 16% on $4.6 Billion Bitcoin Purchase

The Motley Fool

NOVEMBER 20, 2024

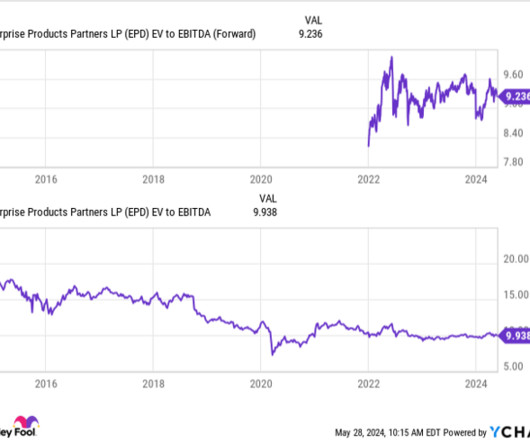

As Microstrategy becomes a pure Bitcoin play, if the enterprise value of the company exceeds the value of the Bitcoin on the balance sheet, it will issue shares to buy Bitcoin. That's the phase they're in right now, and it's a feedback loop, creating demand for Bitcoin, which increases the value of the balance sheet.

Let's personalize your content