Forget Chipotle's Stock Split: Buy This Monster Restaurant Growth Stock Instead

The Motley Fool

MAY 6, 2024

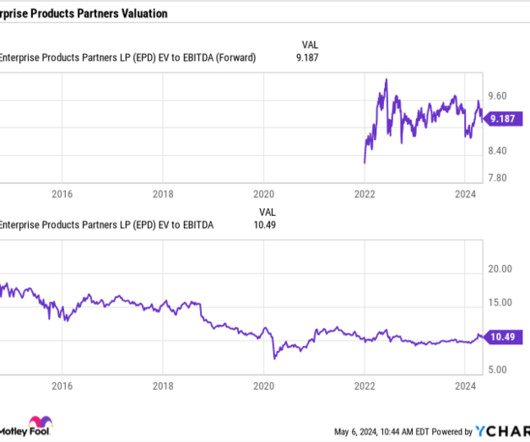

With minimal cash on the balance sheet and over $600 million in debt and tax receivable liabilities with its old private equity owners, the stock has an enterprise value of approximately $1.5 In a few years, it should be doing $100 million in earnings, which would give the stock an enterprise value-to-earnings (EV/E) of 15.

Let's personalize your content