Not Sure Which Dividend Stock You Should Own? Buy This Exchange-Traded Fund and Relax

The Motley Fool

DECEMBER 7, 2023

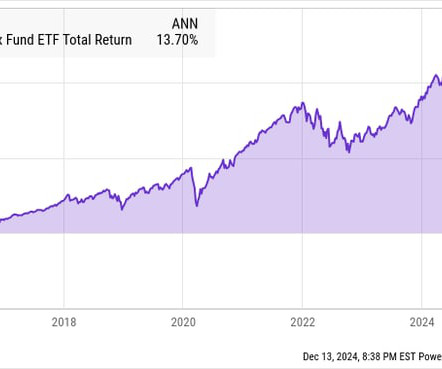

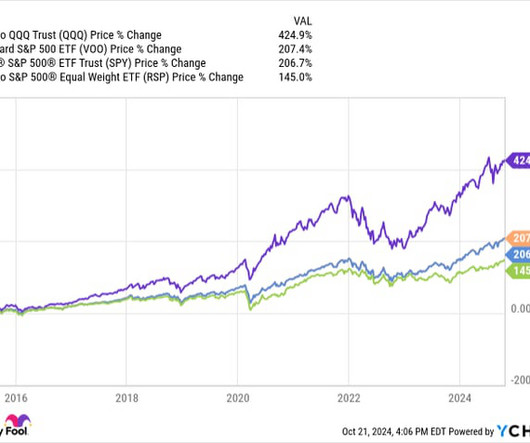

Dividend raisers have outperformed the S&P 500 over the past 50 years According to a study by Hartford Funds, 69% of the S&P 500 index's total returns since 1960 are attributable to the contributions of reinvested dividends to its compound growth. In the same period, an equal-weight S&P 500 fund returned 7.7%

Let's personalize your content