3 Vanguard Exchange-Traded Funds (ETFs) to Buy Hand Over Fist and 1 to Avoid

The Motley Fool

AUGUST 26, 2024

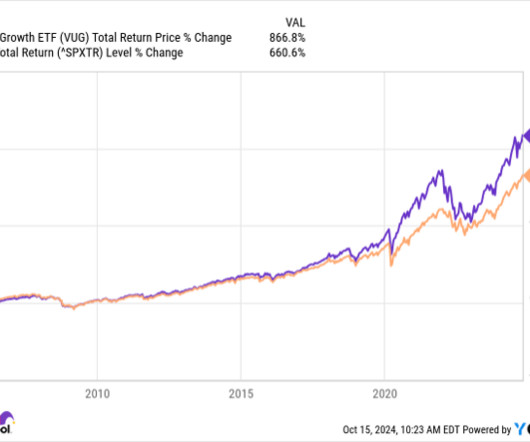

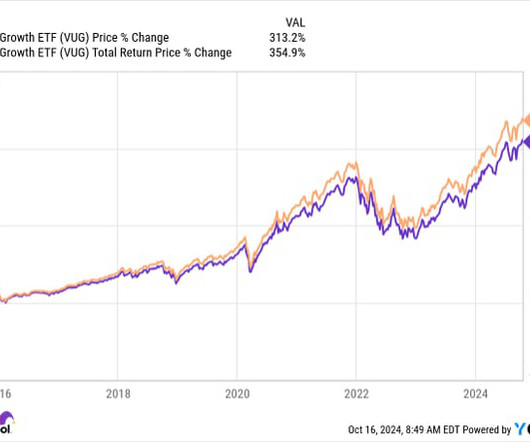

Exchange-traded funds (ETFs) are one of the best ways investors can build wealth. These funds are a lot like mutual funds with a key difference: You can trade them on the open market just like a stock. One of the most successful and largest fund managers is Vanguard, which offers 86 ETFs that hold $2.8

Let's personalize your content