3 Magnificent S&P 500 Dividend Stocks Down 22%, 35%, and 45% to Buy and Hold Forever

The Motley Fool

SEPTEMBER 8, 2024

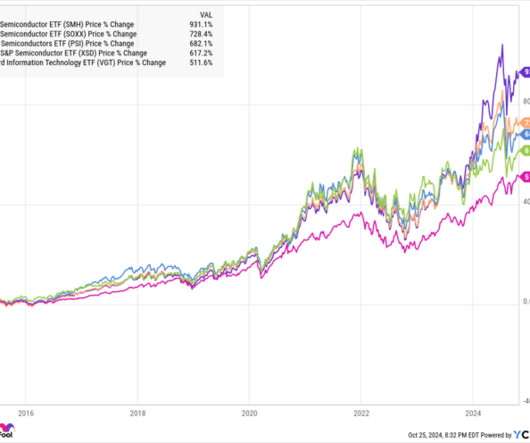

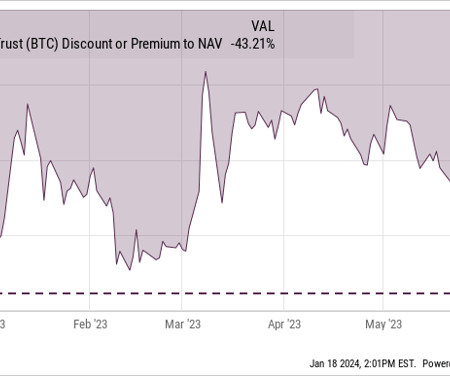

Investors appear to be increasingly interested in exchange-traded funds (ETFs) , or even individual stocks. Traditional mutual funds like the ones its investment company Franklin Templeton mostly manages appear to be falling out of favor. Frankin's total assets under management (AUM) currently stands at $1.66

Let's personalize your content