If This Is a New Bull Market, You Haven't Missed out on Charles Schwab

The Motley Fool

JULY 22, 2023

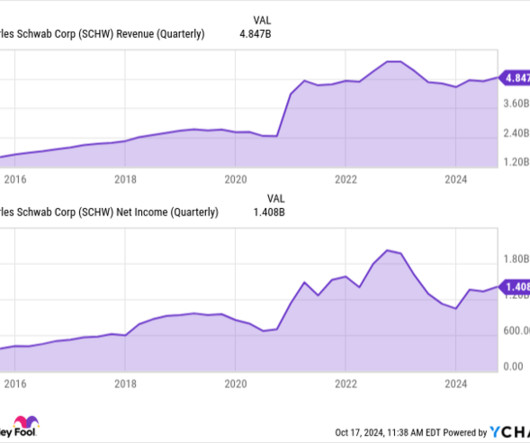

Still a good value Charles Schwab is the largest brokerage firm in the country with about $8 trillion in client assets under management (AUM) and more than 34 million accounts as of June 30. The financial services giant also has wealth management, financial advisory, banking, lending, credit cards, and other services.

Let's personalize your content