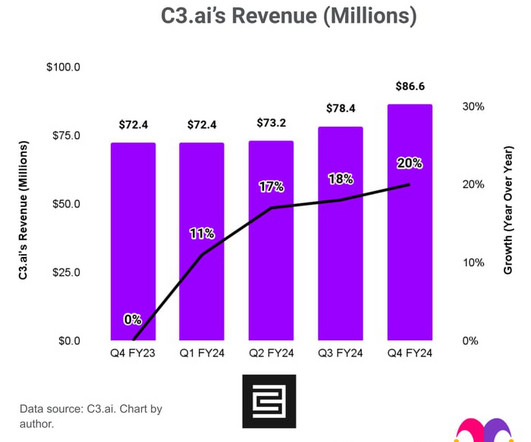

Here's the Number Every C3.ai Stock Investor Needs to Watch in September

The Motley Fool

AUGUST 17, 2024

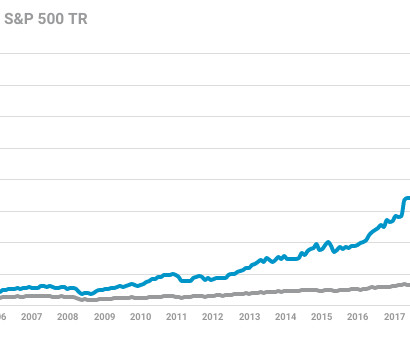

ai (NYSE: AI) was one of the world's first enterprise artificial intelligence (AI) companies. It has built a portfolio of over 40 ready-made AI applications for businesses in 19 different industries, including financial services, energy, and manufacturing. since becoming a public company nearly four years ago.

Let's personalize your content