Want to Outperform 98% of Professional Mutual Fund Managers? Buy This 1 Investment and Hold It Forever.

The Motley Fool

DECEMBER 15, 2024

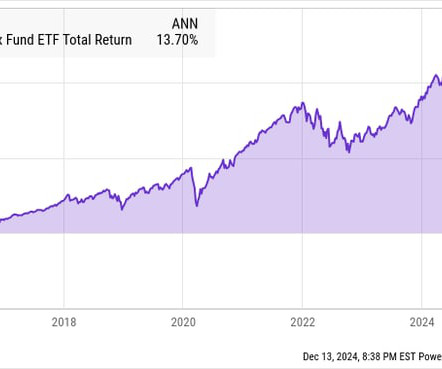

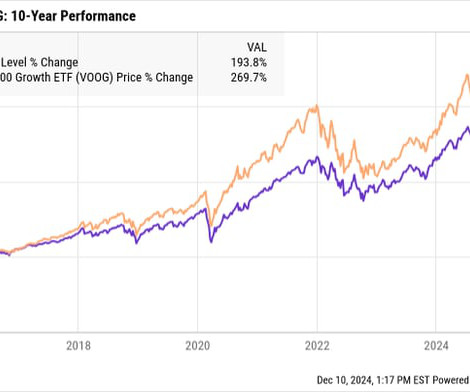

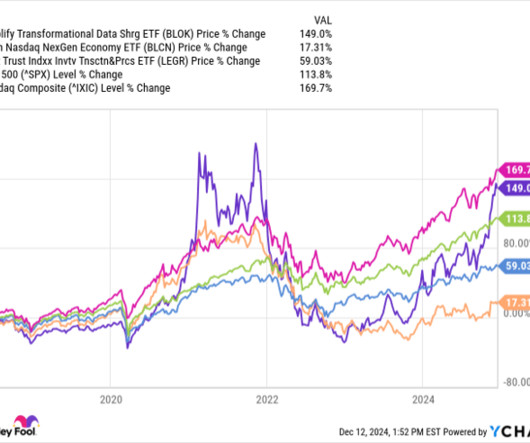

Professional fund managers tend to be highly educated, hard-working, and extremely smart. But it doesn't take a highly complex trading plan to come out ahead of 98% of professional mutual fund managers over the long run. If you want to beat the professionals, your best bet is to buy a broad-based index fund and just hold onto it.

Let's personalize your content