Billionaire Stanley Druckenmiller Sold 88% of Duquesne's Stake in Nvidia and Is Piling Into 2 Unstoppable Stocks

The Motley Fool

OCTOBER 10, 2024

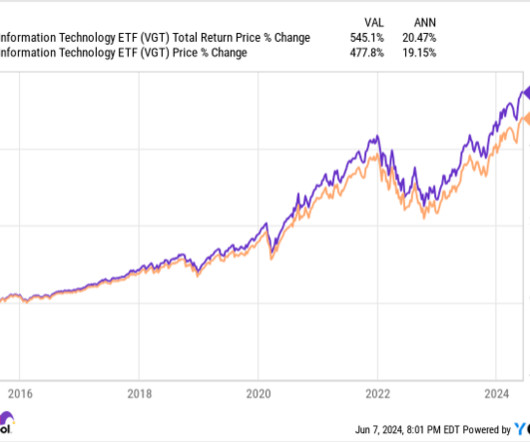

six weeks packed full of operating results from public companies), can make it easy for important data to fly under the radar. A 13F provides a clear snapshot of which stocks and exchange-traded funds (ETFs) the top money managers purchased and sold in the latest quarter. Image source: Getty Images. and global economy.

Let's personalize your content