IPO Alert: You'll Soon Be Able to Invest Alongside Billionaire Bill Ackman

The Motley Fool

JULY 12, 2024

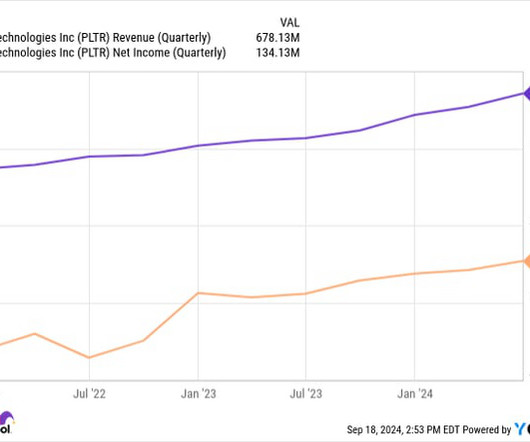

What we know about Pershing Square USA This will be a unique investment vehicle. It's important to note that this is not an IPO of Bill Ackman's well-known Pershing Square hedge fund, which owns stakes in companies such as Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG) and Chipotle (NYSE: CMG). annualized).

Let's personalize your content