BlackRock (BLK) Q3 2024 Earnings Call Transcript

The Motley Fool

OCTOBER 11, 2024

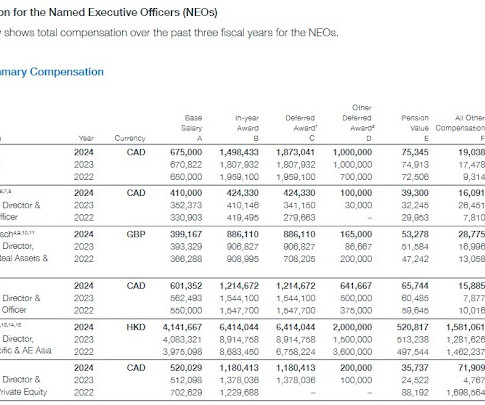

The combination triples infrastructure AUM and doubles private markets run-rate management fees. This was due to the relative outperformance of lower fee U.S. equity markets and client preferences for lower fee U.S. The closing of GIP added $116 billion of client AUM and $70 billion of fee-paying AUM on October 1.

Let's personalize your content