Uber Beats Analyst Estimates, Tips the Scale From Growth Mode to Its First Annual Profit as a Public Company

The Motley Fool

FEBRUARY 12, 2024

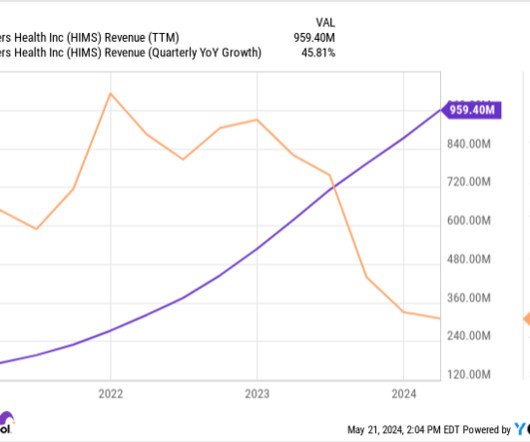

On the bottom line, the company continued to deliver impressive margin expansion as it built operating leverage. Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month.

Let's personalize your content