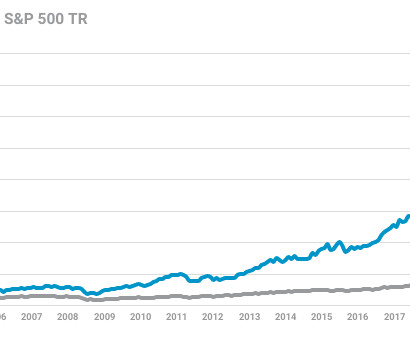

Down 97%, Is It Time to Buy Spirit Airlines Stock?

The Motley Fool

OCTOBER 6, 2024

The business carries a whopping $7 billion of debt and operating lease liabilities. Throughout its entire history as a public company, shares have never had this low of a valuation. It's hard to have any sort of confidence as it pertains to Spirit's prospects. Is Spirit too cheap to ignore?

Let's personalize your content