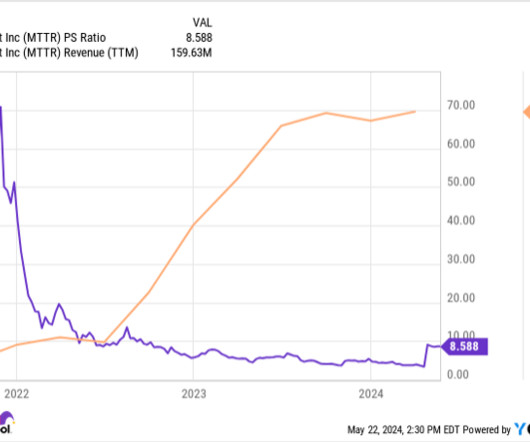

Is Matterport a Worthy Merger Arbitrage Play?

The Motley Fool

MAY 28, 2024

CoStar management believes the deal will go through before the end of 2024, but it still needs to pass shareholder and regulatory hurdles. As a result, the proposed acquisition creates an opportunity known as merger arbitrage -- a short-term investing strategy where you buy stocks of companies trading below their acquisition prices.

Let's personalize your content