Why Shares of VinFast Auto Collapsed This Week

The Motley Fool

SEPTEMBER 8, 2023

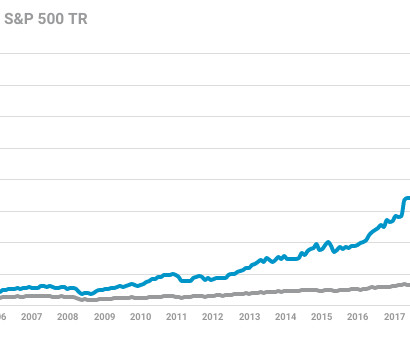

What happened Shares of recently minted public company VinFast Auto (NASDAQ: VFS) collapsed as much as 44.6% The Vietnamese manufacturer of electric vehicles ( EVs ) just went public through a special purpose acquisition company (SPAC) and soared over 100% on the back of investor hype and its low float.

Let's personalize your content