PizzaExpress shareholders back £20m equity injection in refinancing to support growth

Private Equity Insights

APRIL 3, 2025

Can`t stop reading?

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Private Equity Insights

APRIL 3, 2025

Can`t stop reading?

The Motley Fool

DECEMBER 17, 2024

He then uses his sway as a large shareholder to influence management and unlock value. Ackman's activist investor strategy requires a highly concentrated portfolio. billion portfolio is invested in just three companies. As a result, over 45% of Pershing Square's $13.4 stock indexes. Both the U.S.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The Motley Fool

FEBRUARY 4, 2025

shareholders: "When we own portions of outstanding businesses with outstanding managements, our favorite holding period is forever." Just this past year, Buffett sold over $134 billion worth of stocks from Berkshire's portfolio as he saw valuations of some holdings climb to a point where it no longer made sense to remain so heavily invested.

The Motley Fool

DECEMBER 25, 2024

He buys into companies with steady growth, robust profitability, strong management teams, and shareholder-friendly initiatives like stock buyback programs and dividend schemes, which help to compound his returns over time. of Berkshire Hathaway's portfolio Amazon (NASDAQ: AMZN) is the world's largest e-commerce company. Amazon: 0.8%

The Motley Fool

DECEMBER 22, 2024

Along with a variety of top stocks like Apple and Coca-Cola , there's another investment Buffett includes in his portfolio. Let's take a closer look at this Buffett-approved investment to add to your portfolio now and potentially score a win from later. He's even recommended this one as a great buy for nonprofessional investors.

The Motley Fool

JANUARY 3, 2025

Zooming out one level, we can now engage in what I call Portfolio-Level Thinking. If you are a shareholder, I wish you the best. I'm looking at my portfolio because we can use our Rule Breaker stock traits to find stocks, and we can use our habits as investors to do things like hold on to them. You end up with a portfolio.

The Motley Fool

JANUARY 11, 2025

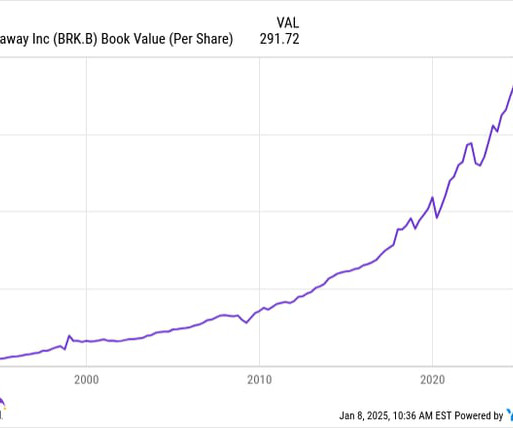

One thing is sure: Berkshire Hathaway creates shareholder value The inner workings of Berkshire Hathaway or any other holding company can seem like murky waters. There, Buffett and the rest of Berkshire Hathaway's management team decide how to use the money to create value for the company's shareholders. So, which is it?

The Motley Fool

NOVEMBER 30, 2024

Nvidia is now the largest position in AQR's portfolio. Nvidia is the second largest position in Citadel's portfolio, excluding options contracts and index funds. Nvidia is the largest holding in Schonfeld's portfolio, excluding index funds. Meanwhile, he added 719,710 shares of Nvidia, upping his position by 5%.

Private Equity Insights

JANUARY 31, 2025

The deal, once completed, will make PAI the largest shareholder, while Ardian will retain a minority stake alongside the companys founders and management team. Ardian, a long-standing shareholder, reaffirmed its commitment to the companys continued success. The transaction is expected to close this summer, pending regulatory approvals.

The Motley Fool

FEBRUARY 4, 2025

See the 10 stocks An unmatched value proposition ExxonMobil CEO Darren Woods showcased the strength of the company's portfolio and strategy when speaking on the fourth-quarter earnings conference call : We are creating unmatched value for our shareholders. For comparison, Chevron 's adjusted earnings were $18.3

The Motley Fool

JANUARY 23, 2025

Collecting dividends While waiting for sales growth to pick up and the stock price to appreciate, PepsiCo's shareholders can confidently rely on dividend payments. Certainly, the payments have become an important way to reward shareholders, and its 76% payout ratio indicates they aren't in danger of getting cut.

The Motley Fool

MARCH 19, 2025

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Let me start by discussing how our deep and robust content portfolio is powering growth. Consider when Nvidia made this list on April 15, 2005.

The Motley Fool

MARCH 26, 2025

Strip malls are the core of the portfolio, with roughly 80% of the company's properties having a grocery store in them. That said, redevelopment and capital investment are themes throughout the portfolio. Boring, predictable, and time-tested Few Federal Realty shareholders are bragging to their friends about this stock.

The Motley Fool

JANUARY 2, 2025

They are also the company's largest shareholders, which means they have a direct stake in its long-term success. This will provide a further cash runway, but will also dilute existing shareholders. But before investors rush to join Uber and Nvidia as a Serve shareholder, they should carefully examine its valuation.

The Motley Fool

DECEMBER 11, 2024

Billionaire Warren Buffett has always had a thing for companies that return capital to their shareholders. Buffett's company Berkshire Hathaway owns several high-yielding stocks in its portfolio. of Berkshire's massive $300 billion-plus equities portfolio. We overpaid for Kraft." KHC Dividend Yield data by YCharts.

The Motley Fool

NOVEMBER 29, 2024

Investors who believe the company is still in the early stages of a long-term global opportunity could consider adding the stock to a diversified portfolio. In my view, shares of IBM within a diversified portfolio should continue to reward shareholders. Should you invest $1,000 in Palantir Technologies right now?

The Motley Fool

FEBRUARY 27, 2025

Let's take a look at the results, what it reveals about the future, and what CEO Jensen Huang said that every shareholder needs to hear. He also uttered eight words that should be of particular interest to Nvidis shareholders: "Future reasoning models can consume much more compute." Image source: Getty Images.

The Motley Fool

FEBRUARY 27, 2025

But perhaps the most insight can be gained from the Oracle of Omaha's annual shareholder letter. Although these shareholder letters are typically known for their unwavering optimism, Buffett's newly released letter contains four of the most chilling words investors will ever witness. Over the previous nine quarters (Oct.

The Motley Fool

MARCH 6, 2025

Berkshire runs a roughly $297 billion equities portfolio and is always looking to deploy cash into well-run companies. Learn More Here are two Buffett stocks to buy hand over fist in March that have stood the test of time in Berkshire's portfolio. Since 2010, the company has distributed over $93 billion in dividends to shareholders.

The Motley Fool

FEBRUARY 28, 2025

These are great dividend stocks to double up on right now, as long as that won't overallocate your portfolio to those positions. billion in dividends to shareholders last year, boosting its total outlay to $93 billion since the start of 2010. Vici Properties has many ways to continue expanding its portfolio. dividend yield.

The Motley Fool

DECEMBER 23, 2024

Dividend stocks reign supreme Companies that pay a regular dividend to their shareholders are almost always profitable on a recurring basis, as well as time-tested. million the company holds in common and preferred equity, PennantPark's $1.984 billion portfolio is spread across 158 investments. For example, if you include the $234.1

The Motley Fool

DECEMBER 2, 2024

Palantir Technologies is delivering a banner year for shareholders driven by exceptional growth and accelerating profitability. stock can work within a diversified portfolio. There's a lot to like about Palantir, but investors may also want to take a look at other industry players following a similar path of disruptive innovation.

The Motley Fool

JANUARY 10, 2025

If you're not a shareholder now, I'd only add a small position size (no more than 1%) to your portfolio if you believe in the business. If it doesn't, then it won't have a massive effect on your overall portfolio value. If UiPath rebounds, you'll still make a solid profit. Should you invest $1,000 in UiPath right now?

The Motley Fool

DECEMBER 13, 2024

In addition to its collection of partly and fully owned private subsidiaries, Buffett's company owns a portfolio of publicly traded stocks that's currently worth $300.5 Investors who dive into the breakdown of Berkshire's portfolio may notice that the portfolio is actually heavily concentrated around a relatively small number of holdings.

The Motley Fool

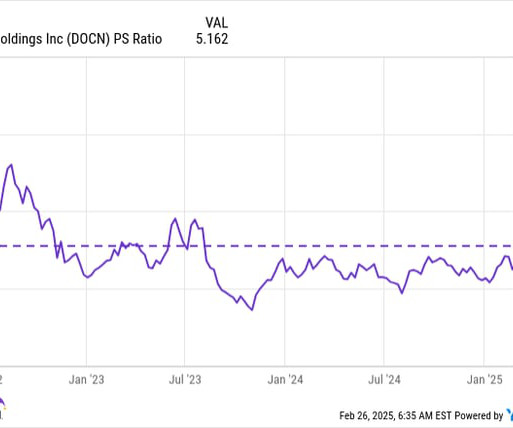

FEBRUARY 27, 2025

DigitalOcean has a growing portfolio of AI services to meet their needs, which includes data center infrastructure, access to leading third-party models like Meta Platforms ' Llama family, and a generative AI platform that allows customers to seamlessly create their own AI agents without any programming experience.

The Motley Fool

JANUARY 9, 2025

These pricey shares are still easy to love The Trade Desk has a shareholder-friendly ability to deliver strong results in a weak economy. Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month.

The Motley Fool

MARCH 21, 2025

Most recently, it has been buying up salty snack companies -- including Dot's Pretzels -- to broaden its portfolio beyond chocolate and other sweets. The company likely has the backing of its largest shareholder to do the right thing, even if the right thing takes some time. Image source: Getty Images.

The Motley Fool

DECEMBER 22, 2024

He has an innate ability to allocate capital into investments that generate outsize returns for his shareholders. As good as the Buffett-led Berkshire Hathaway is at growing shareholder value, Brookfield Corporation (NYSE: BN) has been even better. Berkshire owns operating businesses (e.g., Berkshire also has insurance operations (e.g.,

The Motley Fool

MARCH 27, 2025

This unmatched heft, combined with a broad portfolio of patent-protected drugs, has helped Pfizer build a wide economic moat around its business. The company's 2023 acquisition of Seagen has also significantly bolstered its oncology portfolio, contributing a noteworthy $3.4 billion in revenue for full-year 2024.

Private Equity Insights

MARCH 10, 2025

Harvest Partners joined as a significant shareholder in 2020 after acquiring a stake from Vista and K1 Investment Management. If completed, the deal would mark a major exit for Vista and Harvest, highlighting the continued strength of the government technology sector in private equity portfolios. Can`t stop reading?

The Motley Fool

NOVEMBER 24, 2024

Shareholders' expectations are sky high. Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. That said, Palantir is also a much larger and more profitable business.

The Motley Fool

JANUARY 16, 2025

However, investors who missed the boat have their sights on the future and what it could bring for their own portfolios. In this instance, long-term shareholders should always want the management team to think about the next decade, as opposed to trying to hit some short-term financial targets. Where to invest $1,000 right now?

The Motley Fool

JANUARY 4, 2025

dividend yield , compensating shareholders for holding the stock. Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. SO PE Ratio (Forward) data by YCharts In the meantime, the stock offers a 3.5%

Private Equity Insights

APRIL 3, 2025

The refinancing, led by Morgan Stanley and JPMorgan, was designed to replace a $4.8bn private credit loan raised less than two years ago, and return $1bn in preferred equity Vista invested in 2023 to complete the original financing. Can`t stop reading?

The Motley Fool

FEBRUARY 13, 2025

Our ability to grow, defend, and launch products across markets drove 14% operational revenue growth in our companion animal portfolio alongside solid 5% operational revenue growth for our livestock portfolio, reflecting our commitment to shareholders, adjusted net income grew 15% operationally. pet care portfolio.

The Motley Fool

JANUARY 3, 2025

Prospective investors should look elsewhere, and current shareholders should consider trimming their positions. Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month.

Private Equity Insights

MARCH 19, 2025

T&D Holdings will become the largest shareholder, while Allianz will acquire a 25% stake. The sale follows Viridiums abandoned attempt to acquire a $20bn life insurance portfolio from Zurich last year. The transaction values Viridium at 3.5bn, including debt.

The Motley Fool

NOVEMBER 8, 2024

We've increased our regular dividend rate 160%; and including both regular and special dividends, paid or committed to pay more than $13 billion directly to shareholders; and $3.2 billion of that free cash flow back to our shareholders through a mix of our regular dividend and opportunistic share repurchases. We generated $1.6

The Motley Fool

MARCH 26, 2025

Warren Buffett's company is in an excellent position to continue growing value for its shareholders in the future. Sign Up For Free A portfolio of great businesses At its core, Berkshire Hathaway is a holding company for a diverse array of great businesses it owns outright. billion, or 23% of Berkshire's investment portfolio.

The Motley Fool

FEBRUARY 21, 2025

The online retail leader keeps winning for shareholders John Ballard (Amazon): Berkshire Hathaway has held a position in Amazon stock since 2019. The Amazon investment might have been made by one of Buffett's investing deputies who oversee a small portion of the company's equity portfolio.

The Motley Fool

DECEMBER 6, 2024

If the euphoria surrounding AI fades, Nvidia and its shareholders would, presumably, feel the pinch. Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Should you invest $1,000 in Nvidia right now?

The Motley Fool

MARCH 6, 2025

Two factors have weighed on the real estate investment trust's ( REIT ) stock price: interest rates and portfolio changes. While interest rates are out of the company's control, it's actively working to rebuild its portfolio. Learn More Pivoting the portfolio W.P. The $110 million acquisition of a 12-property portfolio of U.S.

The Motley Fool

FEBRUARY 14, 2025

He hasn't spent anywhere close to this amount of money buying shares of any other company in Berkshire Hathaway's 44-stock, $299 billion investment portfolio. Steadily reducing the company's share count helps to gradually increase the ownership stakes of existing shareholders. Consider when Nvidia made this list on April 15, 2005.

Private Equity Insights

MARCH 10, 2025

With Stonepeak now joining forces with KKR, Assuras board acknowledged the consortiums long-term infrastructure investment approach and commitment to expanding Assuras portfolio. The board also noted extensive consultations with major shareholders, which contributed to its stance on the latest offer.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content