Vance Street Seals the Deal

Private Equity Professional

DECEMBER 18, 2024

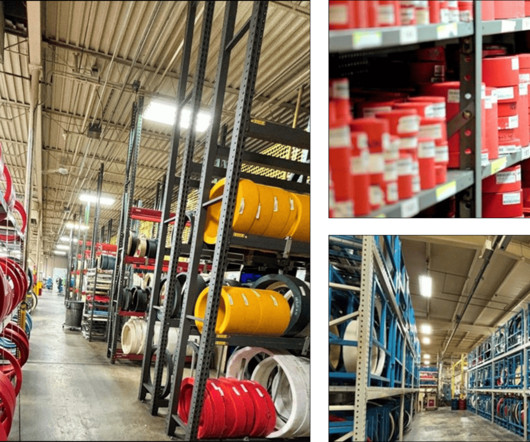

Vance Street Capital has acquired System Seals , a Cleveland-based designer and manufacturer of high-performance sealing products. System Seals specializes in designing and manufacturing proprietary, high-performance sealing products that require high compliance, material, performance, or tolerance requirements, particularly for systems with high failure costs.

Let's personalize your content